If you’re new to the world of credit, or if you’ve never looked closely at your credit card statement before, it can be a lot to take in. We’ll break down the different sections you can expect to find on a typical credit card statement and what the key terms mean.

What is a credit card statement?

A credit card statement is the summary of activity on your credit card. This statement will show you information such as purchases you have made, any interest charges you may have incurred and any rewards earned. Credit card statements are sent out each billing cycle, which is typically about 28 to 30 days but can range anywhere from 20 to 45 days.

You can access your credit card statement by going to your online account and clicking on statement information. If you signed up for electronic statements, the card issuer will send you an email every month when your new statement is available. If you don’t already have an online account, you can create one through your card issuer’s website.

How to read a credit card statement

You’ll receive your credit card statement once a month in the mail, although you’ll also have access through your online account. You can also opt out of the paper copies and choose to receive online statements only. However you choose to read it, these are the sections you can expect to find:

Account information

- Name: Your full legal name that you used when you applied for the card should be on your account. If there are any spelling errors, contact the issuer to make sure your name is spelled correctly as you don’t want your information incorrectly reported to the three major credit bureaus.

- Address: Check that the spelling and numbers used for your address are also correct. This can also help avoid any issues and errors on your credit report.

- Account number: This helps identify your specific card. It may appear on your statement either as the full account number or just the last four digits.

- Billing cycle dates: Be aware that your billing cycle does not necessarily correspond to the calendar month. For example, your billing cycle may end on the 15th of the month, rather than the last day of the month. Your credit card statement will show any transactions made in the billing period. Any purchases made after the last date will appear in the statement for the next billing cycle.

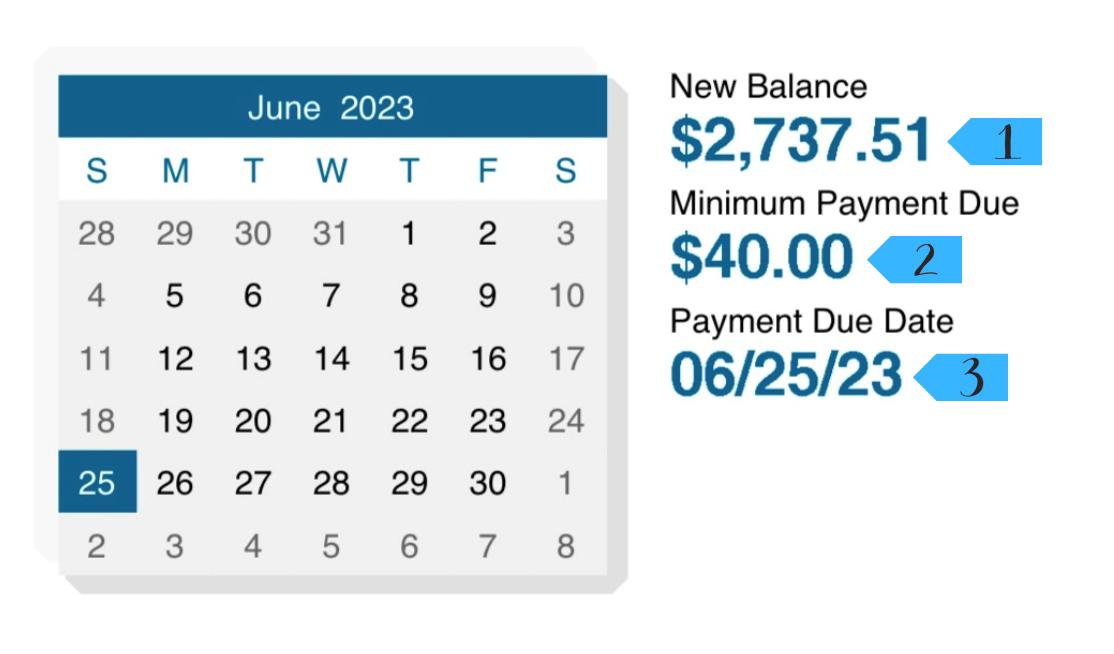

Balances and payments due

Your statement will show you what you owe based on charges made during the billing cycle. You will see the minimum payment you need to pay, if you aren’t paying in full, as well as the payment due date.

1. New balance: This is the total amount you owe on the account for any charges made during the billing period plus any previous balance you carried over, after any credits or payments have been subtracted.

2. Minimum payment due: This is the smallest amount you can pay in order to keep your account current and not flagged as past due. Keep in mind that paying only the minimum each month is likely to result in expensive interest charges and a growing balance due to compounding interest.

3. Payment due date: This is the date your payment is due. Generally, in order to avoid any late fees, your issuer must receive your payment no later than 5 p.m. that day. If the due date falls on a weekend or holiday, and you’re submitting your payment by mail, you should be OK if your payment is received by the next business day.

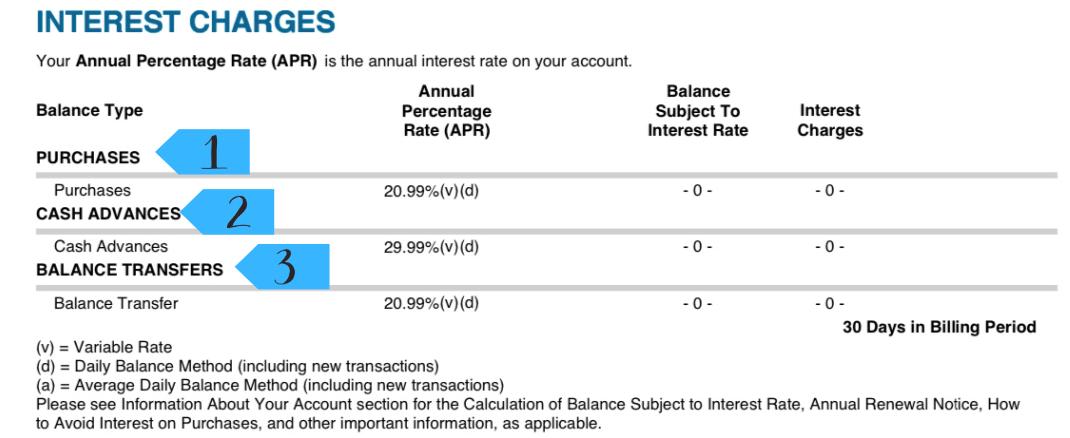

Interest

Your credit card may charge different interest rates on different types of transactions. The interest rate, or annual percentage rate (APR), for each type of transaction will be clearly spelled out on your statement. This information was also in the terms and conditions of your credit card when you were approved.

1. Purchases: This section shows any interest charges that were assessed this billing period on purchases made with the card.

2. Cash advances: This section shows interest incurred during the billing period on any cash advances you took out.A cash advance is when you use your credit card to withdraw cash, for example at an ATM. Cash advances should almost always be a last resort because cash advances don’t get a grace period like purchases do, meaning you’ll be charged interest immediately. Plus, there’s often a higher interest rate on cash advances, as well as a cash advance fee.

3. Balance transfers: When you transfer debt from an old credit card to a new one with a different issuer, you generally receive a temporary lower interest rate, often a 0% APR. This section will show interest incurred during the billing period on any transferred balances.

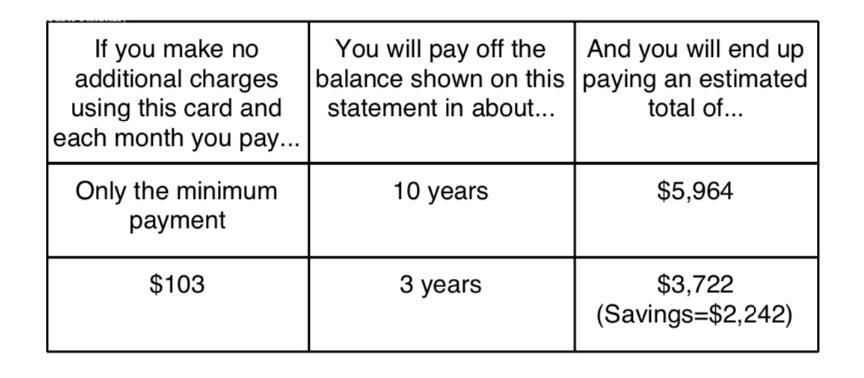

Some issuers will also include in your statement the late fee for not paying on time. You may also see a warning with the interest you would end up paying after a certain number of years if you continue to only pay the minimum amount each billing period.

It’s wise to pay in full each billing cycle to avoid interest charges. Although your issuer allows you to pay just a minimum amount, paying the minimum and carrying a balance will result in you paying a substantial amount of interest before you finish paying off the principal of your debt.

Here’s an example of what you might find on your statement indicating how much you could owe in various repayment scenarios:

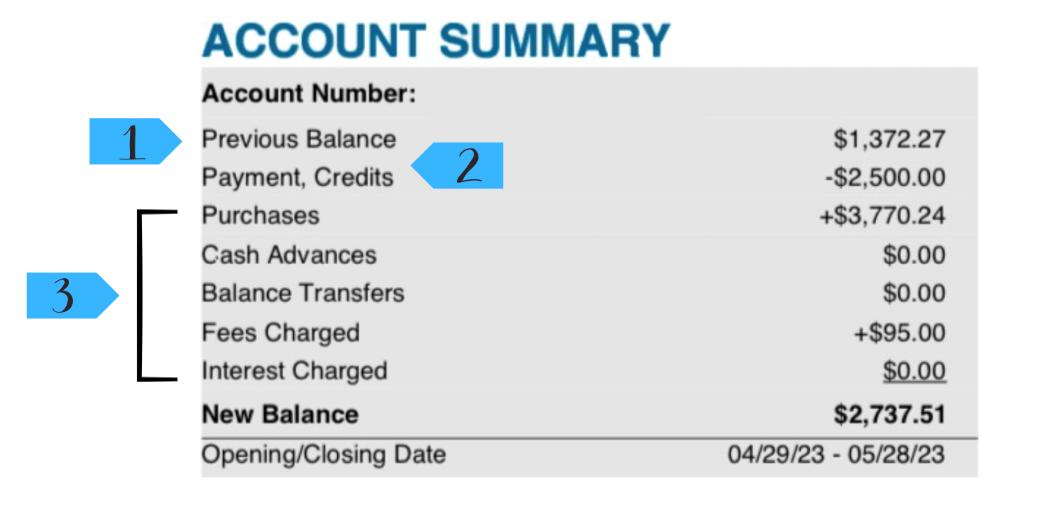

Account summary

This section contains information on the following:

1. Your previous balance. This is the amount, if any, you still owe on your card.

2. Any payments or any credits to your account. This includes your monthly payment and any credits from returning items you’ve purchased or applying cash-back rewards to your statement balance.

3. New charges. This includes any new purchases, balance transfers, cash advances, fees or interest charges.

Added together, all of these items make up your new balance. Note that your new balance might not be exactly the same as your current balance — what you’d see if you logged in online or hear if you called the issuer by phone — because it doesn’t include activity that occurred after the statement closing date.

Want to stay on top of what you owe? How to check your credit card balance

Transactions

Transactions made during the billing cycle will show up on your statement, and you can see the exact day you made your purchase and where.

- Transaction date: Each transaction listed on your statement should show the date you made the purchase.

- Merchant name and location: Next to the transaction date should be the vendor’s name and the location of where the purchase took place or where the company is based.

- Amount spent: The price of each transaction will show next to the merchant’s name and location. Check that the amount is correct in case of an error.

Rewards

Rewards credit cards come in a few different types, including:

- Cash-back credit cards.

- Travel credit cards.

- Co-branded airline and hotel credit cards.

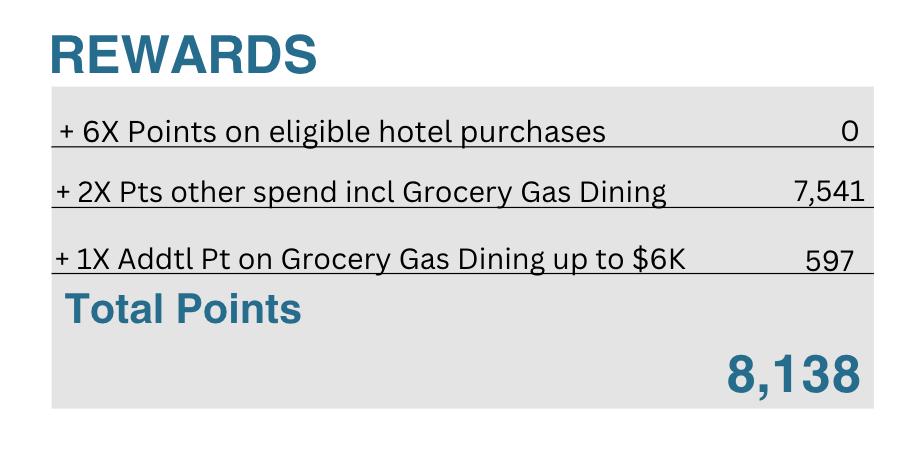

If your credit card earns rewards, you should have a section on your statement showing how much you earned in rewards on purchases made during the billing cycle. Many rewards credit cards earn different rates for purchases in specific categories. If that’s the case, this section of your statement may break down how much you earned on purchases in those categories.

Why it’s important to understand your statement

If you understand how to read your credit card statement, you’ll be more likely to catch any errors or fraudulent charges early and report them to your issuer. Plus, you’ll be more empowered to keep up with payments and avoid incurring late fees or an elevated penalty APR for missing a due date.

Late payments will damage your credit score. How much your score is impacted can depend on factors like the date you sent your payment in, if you have made late payments previously and what your credit history looks like in general. It’s best to avoid paying late or missing a payment as this can have a major adverse impact on your score.

If you’re carrying a balance, reviewing your credit card statement will also help you understand what you’re paying in interest. We always recommend paying your card off in full each month if possible, unless you’re strategically using a card with a 0% intro APR offer.